DHAKA, May 28, 2023 (BSS) - Riding on ongoing investments, efforts to scale operations using state-of-the-art technologies, acquiring more customers and merchants, and thus expanding the financial outreach, Nagad is poised to become a profitable venture by 2025.

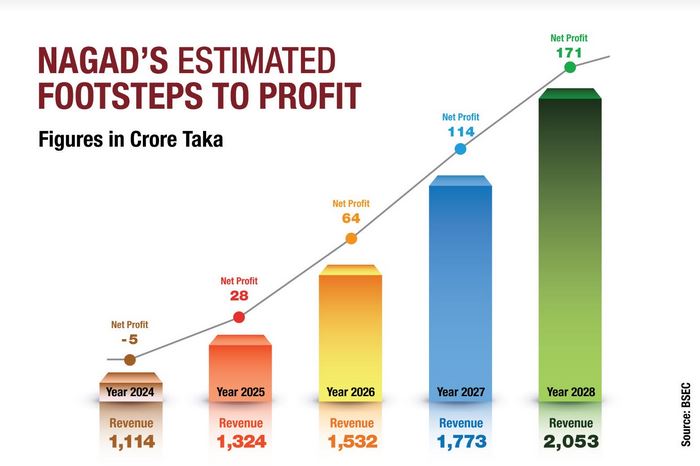

The country's fastest-growing MFS carrier of the Bangladesh Post Office will see its annual losses coming down at only Taka 5 crore in 2024 before it moves into profitability in 2025, when its net profit is projected to reach Taka 28 crore, according to financial projections for Nagad Limited in a prospectus submitted recently to Bangladesh Securities and Exchange Commission (BSEC).

In the following year in 2026, Nagad's net profit would more than double Taka 64 crore. And, from 2027, Nagad's profit will surpass Taka 100 crore a year, as shown in Nagad's financial projections.

The change-maker mobile money carrier is also very optimistic about fetching a profit of Taka 171 crore in 2028, read the document that Nagad submitted to the BSEC to get approval for issuing zero-coupon bonds worth Taka 510 crore.

Mohammad Rezaul Karim, executive director and spokesperson of BSEC, said, "Nagad has secured bond issuance approval as it has enough liquidity and shown profitability forecasts as well."

"Nagad is spending on so many things including giving bonuses, cashbacks to customers," he said hoping that the company would move into profits very soon.

Nagad forecasts that it would generate net revenue of Taka 1,144 crore in 2024, Taka 1,324 crore in 2025, Taka 1,532 crore in 2026, Taka 1,773 crore in 2027 and Taka 2,053 crore in 2028.

Nagad has now gone for a massive investment in infrastructure development and technological upgradation to ensure better service to its customers with diversified products.

Thanks to its one after another innovation, the MFS company has already gained a huge customer base of more than 7.5 crore with its daily transactions hitting Taka 1,200 crore on average.

To improve customer experience, it has all plans lined up to emerge as a complete financial solution. All necessary investments are being made for this purpose.

All such investments have delayed the MFS's profitability for now, but will pay dividends in the long run, said the authorities concerned.

They also hoped that in this way, they would be able to establish a sustainable revenue stream.

Muhammad Zahidul Islam, head of public communication at Nagad, said from the financial transaction point of view, they are more focused on upgrading people's lives to the digital space, rather than ensuring the company's profitability.

"Profits will automatically come, and we're not concerned about that. Our main target is to bring change to people's lives by ensuring seamless digital transactions for them. This will fasten the country's shift to a cashless society; in this process, we'll move into profitability too," Zahidul added.

Industry experts said losing money is no one's priority, but the fact is that startups focused on rapid growth do burn through financial resources before they start earning profits.

The same is true in the case of fintech startups like Nagad, they noted.

Rashad Kabir, managing director of Dream71 Bangladesh and director of the Bangladesh Association of Software and Information Services (BASIS), said, "I believe there is nothing wrong if a startup is counting losses as long as there is a way to become profitable. Global companies, such as Amazon, Facebook Walmart, Uber, etc. are prime examples of building growth before profitability."

Echoing Kabir, Zahidul said it is not Nagad alone, all startups across the globe have to burn through their financial assets before they turn into profits. "Many top Bangladeshi brands have also gone through a similar situation. They had suffered recurring losses for a certain period before they came into profits."

Various government disbursements done successfully by Nagad have already helped this company to gain a strong position when it comes to revenue generation.

Various campaigns, especially the ongoing BMW campaign, have played a crucial role in boosting its daily transactions as well as revenue. All these bear testimony to Nagad's growing strength that will soon turn it into a profitable company.